Factoring (finance)

| Corporate finance |

|---|

| Working capital |

| Capital budgeting |

| Sections |

| Societal components |

Factoring is a financial transaction whereby a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. In "advance" factoring, the factor provides financing to the seller of the accounts in the form of a cash "advance," often 70-85% of the purchase price of the accounts, with the balance of the purchase price being paid, net of the factor's discount fee (commission) and other charges, upon collection. In "maturity" factoring, the factor makes no advance on the purchased accounts; rather, the purchase price is paid on or about the average maturity date of the accounts being purchased in the batch. Factoring differs from a bank loan in several ways. The emphasis is on the value of the receivables (essentially a financial asset), whereas a bank focuses more on the value of the borrower's total assets, and often considers, in underwriting the loan, the value attributable to non-accounts collateral owned by the borrower also, such as inventory, equipment, and real property,[1][2] i.e., matters beyond the credit worthiness of the firm's accounts receivables and of the account debtors (obligors) thereon. Secondly, factoring is not a loan – it is the purchase of a financial asset (the receivable). Third, a nonrecourse factor assumes the "credit risk", that a purchased account will not collect due solely to the financial inability of account debtor to pay. In the United States, if the factor does not assume credit risk on the purchased accounts, in most cases a court will recharacterize the transaction as a secured loan.

It is different from forfaiting in the sense that forfaiting is a transaction-based operation involving exporters in which the firm sells one of its transactions,[3] while factoring is a Financial Transaction that involves the Sale of any portion of the firm's Receivables.[1][2]

Factoring is a word often misused synonymously with invoice discounting - factoring is the sale of receivables, whereas invoice discounting is borrowing where the receivable is used as collateral.

The three parties directly involved are: the one who sells the receivable, the debtor (the account debtor, or customer of the seller), and the factor. The receivable is essentially a financial asset associated with the debtor's liability to pay money owed to the seller (usually for work performed or goods sold). The seller then sells one or more of its invoices (the receivables) at a discount to the third party, the specialized financial organization (aka the factor), often, in advance factoring, to obtain cash. The sale of the receivables essentially transfers ownership of the receivables to the factor, indicating the factor obtains all of the rights associated with the receivables.[1][2] Accordingly, the factor obtains the right to receive the payments made by the debtor for the invoice amount and, in nonrecourse factoring, must bear the loss if the account debtor does not pay the invoice amount due solely to his or its financial inability to pay. Usually, the account debtor is notified of the sale of the receivable, and the factor bills the debtor and makes all collections; however, non-notification factoring, where the client (seller) collects the accounts sold to the factor, as agent of the factor, also occurs. There are three principal parts to "advance" factoring transaction; (a) the advance, a percentage of the invoice face value that is paid to the seller at the time of sale, (b) the reserve, the remainder of the purchase price held until the payment by the account debtor is made and (c) the discount fee, the cost associated with the transaction which is deducted from the reserve, along with other expenses, upon collection, before the reserve is disbursed to the factor's client. Sometimes the factor charges the seller (the factor's "client") both a discount fee, for the factor's assumption of credit risk and other services provided, as well as interest on the factor's advance, based on how long the advance, often treated as a loan (repaid by set-off against the factor's purchase obligation, when the account is collected), is outstanding.[4] The factor also estimates the amount that may not be collected due to non-payment, and makes accommodation for this in pricing, when determining the purchase price to be paid to the seller. The factor's overall profit is the difference between the price it paid for the invoice and the money received from the debtor, less the amount lost due to non-payment.[2]

In the United States, under the Generally Accepted Accounting Principles receivables are considered sold, under Statement of Financial Accounting Standards No. 140, when the buyer has "no recourse,".[5] Moreover, to treat the transaction as a sale under GAAP, the seller's monetary liability under any "recourse" provision must be readily estimated at the time of the sale. Otherwise, the financial transaction is treated as a loan, with the receivables used as collateral.

Contents |

History

Factoring's origins lie in the financing of trade, particularly international trade. Factoring as a fact of business life was underway in England prior to 1400, and it came to America with the Pilgrims, around 1620.[6] It appears to be closely related to early merchant banking activities. The latter however evolved by extension to non-trade related financing such as sovereign debt.[7] Like all financial instruments, factoring evolved over centuries. This was driven by changes in the organization of companies; technology, particularly air travel and non-face to face communications technologies starting with the telegraph, followed by the telephone and then computers. These also drove and were driven by modifications of the common law framework in England and the United States.[8]

Governments were latecomers to the facilitation of trade financed by factors. English common law originally held that unless the debtor was notified, the assignment between the seller of invoices and the factor was not valid. The Canadian Federal Government legislation governing the assignment of moneys owed by it still reflects this stance as does provincial government legislation modelled after it. As late as the current century the courts have heard arguments that without notification of the debtor the assignment was not valid. In the United States, by 1949 the majority of state governments had adopted a rule that the debtor did not have to be notified thus opening up the possibility of non-notification factoring arrangements.[9]

Originally the industry took physical possession of the goods, provided cash advances to the producer, financed the credit extended to the buyer and insured the credit strength of the buyer.[10] In England the control over the trade thus obtained resulted in an Act of Parliament in 1696 to mitigate the monopoly power of the factors. With the development of larger firms who built their own sales forces, distribution channels, and knowledge of the financial strength of their customers, the needs for factoring services were reshaped and the industry became more specialized.

By the twentieth century in the United States factoring was still the predominant form of financing working capital for the then high growth rate textile industry. In part this occurred because of the structure of the US banking system with its myriad of small banks and consequent limitations on the amount that could be advanced prudently by any one of them to a firm.[11] In Canada, with its national banks the limitations were far less restrictive and thus factoring did not develop as widely as in the US. Even then factoring also became the dominant form of financing in the Canadian textile industry.

Today factoring's rationale still includes the financial task of advancing funds to smaller rapidly growing firms who sell to larger more creditworthy organizations. While almost never taking possession of the goods sold, factors offer various combinations of money and supportive services when advancing funds.

Factors often provide their clients four key services: information on the creditworthiness of their prospective customers domestic and international, and, in nonrecourse factoring, acceptance of the credit risk for "approved" accounts; maintain the history of payments by customers (i.e., accounts receivable ledger); daily management reports on collections; and, make the actual collection calls. The outsourced credit function both extends the small firms effective addressable marketplace and insulates it from the survival-threatening destructive impact of a bankruptcy or financial difficulty of a major customer. A second key service is the operation of the accounts receivable function. The services eliminate the need and cost for permanent skilled staff found within large firms. Although today even they are outsourcing such backoffice functions. More importantly, the services insure the entrepreneurs and owners against a major source of a liquidity crises and their equity.

In the latter half of the twentieth century the introduction of computers eased the accounting burdens of factors and then small firms. The same occurred for their ability to obtain information about debtor’s creditworthiness. Introduction of the Internet and the web has accelerated the process while reducing costs. Today credit information and insurance coverage is available any time of the day or night on-line. The web has also made it possible for factors and their clients to collaborate in realtime on collections. Acceptance of signed documents provided by facsimile as being legally binding has eliminated the need for physical delivery of “originals”, thereby reducing time delays for entrepreneurs.

By the first decade of the twenty first century a basic public policy rationale for factoring remains that the product is well suited to the demands of innovative rapidly growing firms critical to economic growth.[12] A second public policy rationale is allowing fundamentally good business to be spared the costly management time consuming trials and tribulations of bankruptcy protection for suppliers, employees and customers or to provide a source of funds during the process of restructuring the firm so that it can survive and grow.

Reason

Factoring is a method used by some firms to obtain cash. Certain companies factor accounts when the available cash balance held by the firm is insufficient to meet current obligations and accommodate its other cash needs, such as new orders or contracts; in other industries, however, such as textiles or apparel, for example, financially sound companies factor their accounts simply because this is the historic method of finance. The use of factoring to obtain the cash needed to accommodate a firm’s immediate cash needs will allow the firm to maintain a smaller ongoing cash balance. By reducing the size of its cash balances, more money is made available for investment in the firm’s growth. Debt factoring is also used as a financial instrument to provide better cash flow control especially if a company currently has a lot of accounts receivables with different credit terms to manage. A company sells its invoices at a discount to their face value when it calculates that it will be better off using the proceeds to bolster its own growth than it would be by effectively functioning as its "customer's bank."[13] Accordingly, factoring occurs when the rate of return on the proceeds invested in production exceed the costs associated with factoring the receivables. Therefore, the trade off between the return the firm earns on investment in production and the cost of utilizing a factor is crucial in determining both the extent factoring is used and the quantity of cash the firm holds on hand.

Many businesses have cash flow that varies. It might be relatively large in one period, and relatively small in another period. Because of this, businesses find it necessary to both maintain a cash balance on hand, and to use such methods as factoring, in order to enable them to cover their short term cash needs in those periods in which these needs exceed the cash flow. Each business must then decide how much it wants to depend on factoring to cover short falls in cash, and how large a cash balance it wants to maintain in order to ensure it has enough cash on hand during periods of low cash flow.

Generally, the variability in the cash flow will determine the size of the cash balance a business will tend to hold as well as the extent it may have to depend on such financial mechanisms as factoring. Cash flow variability is directly related to 2 factors:

- The extent cash flow can change,

- The length of time cash flow can remain at a below average level.

If cash flow can decrease drastically, the business will find it needs large amounts of cash from either existing cash balances or from a factor to cover its obligations during this period of time. Likewise, the longer a relatively low cash flow can last, the more cash is needed from another source (cash balances or a factor) to cover its obligations during this time. As indicated, the business must balance the opportunity cost of losing a return on the cash that it could otherwise invest, against the costs associated with the use of factoring.

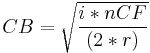

The cash balance a business holds is essentially a demand for transactions money. As stated, the size of the cash balance the firm decides to hold is directly related to its unwillingness to pay the costs necessary to use a factor to finance its short term cash needs. The problem faced by the business in deciding the size of the cash Balance it wants to maintain on hand is similar to the decision it faces when it decides how much physical inventory it should maintain. In this situation, the business must balance the cost of obtaining cash proceeds from a factor against the opportunity cost of the losing the Rate of Return it earns on investment within its business.[14] The solution to the problem is:

where

is the cash balance

is the cash balance is the average negative cash flow in a given period

is the average negative cash flow in a given period is the [discount rate] that cover the factoring costs

is the [discount rate] that cover the factoring costs is the rate of return on the firm’s assets.[16]

is the rate of return on the firm’s assets.[16]

Other definition from Factoring Chain International:

How does international factoring work?

There is nothing complex about factoring. It is simply a unique package of services designed to ease the traditional problems of selling on open account. Typical services include investigating the creditworthiness of buyers, assuming credit risk and giving 100% protection against write-offs, collection and management of receivables and provision of finance through immediate cash advances against outstanding receivables.

When export factoring is carried out by members of FCI, the service involves a five or six stage operation.

- The exporter signs a factoring contract assigning all agreed receivables to an export factor. The factor then becomes responsible for all aspects of the factoring operation.

- The export factor chooses an FCI correspondent to serve as an import factor in the country where goods are to be shipped. The receivables are then reassigned to the import factor.

- At the same time, the import factor investigates the credit standing of the buyer of the exporter's goods and establishes lines of credit. This allows the buyer to place an order on open account terms without opening letters of credit.

- Once the goods have been shipped, the export factor may advance up to 80% of the invoice value to the exporter.

- Once the sale has taken place, the import factor collects the full invoice value at maturity and is responsible for the swift transmission of funds to the export factor who then pays the exporter the outstanding balance.

- If after 90 days past due date an approved invoice remains unpaid, the import factor will pay 100% of the invoice value under guarantee.

Not only is each stage designed to ensure risk-free export sales, it lets the exporter offer more attractive terms to overseas customers. Both the exporter and the customer also benefit by spending less time and money on administration and documentation. In all cases, exporters are assured of the best deal in each country. This is because export factors never appoint an import factor solely because the company is a fellow member of FCI. Import factors are invited to compete for business and those with superior services are selected.

In some situations, FCI members handle their client's business without involving another factor. This is becoming more common in the European Union where national boundaries are disappearing. However FCI members conduct their business, one thing remains certain. Their aim is to make selling in the complex world of international trade as easy for clients as dealing with local customers.

Differences from bank loans

Factors make funds available, even when banks would not do so, because factors focus first on the credit worthiness of the debtor, the party who is obligated to pay the invoices for goods or services delivered by the seller. In contrast, the fundamental emphasis in a bank lending relationship is on the creditworthiness of the borrower, not that of its customers. While bank lending is cheaper than factoring, the key terms and conditions under which the small firm must operate differ significantly.

From a combined cost and availability of funds and services perspective, factoring creates wealth for some but not all small businesses. For small businesses, their choice is slowing their growth or the use of external funds beyond the banks. In choosing to use external funds beyond the banks the rapidly growing firm’s choice is between seeking venture capital (i.e., equity) or the lower cost of selling invoices to finance their growth. The latter is also easier to access and can be obtained in a matter of a week or two, whereas securing funds from venture capitalists can typically take up to six months. Factoring is also used as bridge financing while the firm pursues venture capital and in conjunction with venture capital to provide a lower average cost of funds than equity financing alone. Of course one needs to note that Equity capital has the highest cost in the long run, as a firm needs to demonstrate higher return on investment for its shareholders Firms can also combine the three types of financing, angel/venture, factoring and bank line of credit to further reduce their total cost of funds whilst at the same time improving cash flow.

As with any technique, factoring solves some problems but not all. Businesses with a small spread between the revenue from a sale and the cost of a sale, should limit their use of factoring to sales above their breakeven sales level where the revenue less the direct cost of the sale plus the cost of factoring is positive.

While factoring is an attractive alternative to raising equity for small innovative fast-growing firms, the same financial technique can be used to turn around a fundamentally good business whose management has encountered a perfect storm or made significant business mistakes which have made it impossible for the firm to work within the constraints of their bank covenants. The value of using factoring for this purpose is that it provides management time to implement the changes required to turn the business around. The firm is paying to have the option of a future the owners control. The association of factoring with troubled situations accounts for the half truth of it being labeled 'last resort' financing. However, use of the technique when there is only a modest spread between the revenue from a sale and its cost is not advisable for turnarounds. Nor are turnarounds usually able to recreate wealth for the owners in this situation.

Large firms use the technique without any negative connotations to show cash on their balance sheet rather than an account receivable entry, money owed from their customers, particularly when these show payments being due for extended periods of time beyond the North American norm of 60 days or less.

Invoice sellers

The invoice seller presents recently generated invoices to the factor in exchange for an amount that is less than the value of the invoice(s) by an agreed upon discount and a reserve. A reserve is a provision to cover short payments, payment of less than the full amount of the invoice by the debtor, or a payment received later than expected. The result is an initial payment followed by a second one equal to the amount of the reserve if the invoice is paid in full and on time or a credit to the account of the seller with the factor. In an ongoing relationship the invoice seller will get their funds one or two days after the factor receives the invoices. Astute invoice sellers can use a combination of techniques to cover the range of 1% to 5% plus cost of factoring for invoices paid within 50 to 60 days or more. In many industries, customers expect to pay a few percentage points higher to get flexible sales terms. In effect the customer is willing to pay the supplier to be their bank and reduce the equity the customer needs to run their business. To counter this it is a widespread practice to offer a prompt payment discount on the invoice. This is commonly set out on an invoice as an offer of a 2% discount for payment in ten days. {Few firms can be relied upon to systematically take the discount, particularly for low value invoices - under $100,000 - so cash inflow estimates are highly variable and thus not a reliable basis upon which to make commitments.} Invoice sellers can also seek a cash discount from a supplier of 2 % up to 10% (depending on the industry standard) in return for prompt payment. Large firms also use the technique of factoring at the end of reporting periods to ‘dress’ their balance sheet by showing cash instead of accounts receivable. There are a number of varieties of factoring arrangements offered to invoice sellers depending upon their specific requirements. The basic ones are described under the heading Factors below.

Factors

When initially contacted by a prospective invoice seller, the factor first establishes whether or not a basic condition exists, does the potential debtor(s) have a history of paying their bills on time? That is, are they creditworthy? (A factor may actually obtain insurance against the debtor’s becoming bankrupt and thus the invoice not being paid.) The factor is willing to consider purchasing invoices from all the invoice seller’s creditworthy debtors. The classic arrangement which suits most small firms, particularly new ones, is full service factoring where the debtor is notified to pay the factor (notification) who also takes responsibility for collection of payments from the debtor and the risk of the debtor not paying in the event the debtor becomes insolvent; i.e., nonrecourse factoring. This traditional method of factoring puts the risk of non-payment fully on the factor, except if the reason for the factor's failure to collect is not related to the financial inability of the account debtor to pay, the sole risk assumed by a nonrecourse factor. If the debtor cannot pay the invoice due to insolvency, it is the factor's problem to deal with and the factor cannot seek payment from the seller. The factor will only purchase solid credit worthy invoices and often turns away average credit quality customers. The cost is typically higher with this factoring process because the factor assumes a greater risk and provides credit checking and payment collection services as part of the overall package. For firms with formal management structures such as a Board of Directors (with outside members), and a Controller (with a professional designation), debtors may not be notified (i.e., non-notification factoring). The invoice seller may not retain the credit control function. If they do then it is likely that the factor will insist on recourse against the seller if the invoice is not paid after an agreed upon elapse of time, typically 60 or 90 days. In the event of non-payment by the customer, the seller must buy back the invoice with another credit worthy invoice. Recourse factoring is typically the lowest cost for the seller because they retain the bad debt risk, which makes the arrangement less risky for the factor.

Despite the fact that most large organizations have in place processes to deal with suppliers who use third party financing arrangements incorporating direct contact with them, many entrepreneurs remain very concerned about notification of their clients. It is a part of the invoice selling process that benefits from salesmanship on the part of the factor and their client in its conduct. Even so, in some industries there is a perception that a business that factors its debts is in financial distress.

There are two principal methods of factoring: recourse and non-recourse. Under recourse factoring, the client is not protected against the risk of bad debts. On the other hand, the factor assumes the entire credit risk under non-recourse factoring i.e., full amount of invoice is paid to the client in the event of the debt becoming bad. Other variations include partial nonrecourse, where the factor's assumption of credit risk is limited by time, and partial recourse, where the factor and its client (the seller of the accounts) share credit risk. Factors never assume "quality" risk, and even a nonrecourse factor can chargeback a purchased account which does not collect for reasons other than credit risk assumed by the factor; for example, because the account debtor disputes the quality or quantity of the goods or services delivered by the factor's client.

Invoice payers (debtors)

Large firms and organizations such as governments usually have specialized processes to deal with one aspect of factoring, redirection of payment to the factor following receipt of notification from the third party (i.e., the factor) to whom they will make the payment. Many but not all in such organizations are knowledgeable about the use of factoring by small firms and clearly distinguish between its use by small rapidly growing firms and turnarounds.

Distinguishing between assignment of the responsibility to perform the work and the assignment of funds to the factor is central to the customer/debtor’s processes. Firms have purchased from a supplier for a reason and thus insist on that firm fulfilling the work commitment. Once the work has been performed however, it is a matter of indifference who is paid. For example, General Electric has clear processes to be followed which distinguish between their work and payment sensitivities. Contracts direct with US Government require an Assignment of Claims which is an amendment to the contract allowing for payments to third parties (factors).

Risks

The most important risks of a factor are:

- Counter party credit risk related to clients and risk covered debtors. Risk covered debtors can be reinsured, which limit the risks of a factor. Trade receivables are a fairly low risk asset due to their short duration.

- External fraud by clients: fake invoicing, mis-directed payments, pre-invoicing, not assigned credit notes, etc. A fraud insurance policy and subjecting the client to audit could limit the risks.

- Legal, compliance and tax risks: large number of applicable laws and regulations in different countries.

- Operational risks, such as contractual disputes.

- Uniform Commercial Code (UCC-1) securing rights to assets.

- IRS liens associated with payroll taxes etc.

- ICT risks: complicated, integrated factoring system, extensive data exchange with client.

Reverse Factoring

We can see nowadays that there is a new process developing: the reverse factoring, or supply chain finance. It uses the strengths of the factoring process, but instead of being started by the supplier, it is the buyer that creates the solution toward a factor. That way, the buyer secures the financing of the invoice, and the supplier gets a better interest rate.

See also

References

- ^ a b c J. Downes, J.E. Goodman, "Dictionary of Finance & Investment Terms", Baron's Financial Guides, 2003. Taken from a combination of the definitions of a financial asset and accounts receivable

- ^ a b c d J. Downes, J.E. Goodman, "Dictionary of Finance & Investment Terms", Baron's Financial Guides, 2003; and J.G.Siegel, N.Dauber & J.K.Shim, "The Vest Pocket CPA", Wiley, 2005.

- ^ Please Refer to the Wiki article, forfaiting, for further discussion on cites.

- ^ J.G.Siegel, N.Dauber & J.K.Shim, "The Vest Pocket CPA", Wiley, 2005.

- ^ This means that the factor cannot obtain additional payments from the seller if the purchased account does not collect due solely to the financial inability to pay of the account debtor; however, "quality recourse" still exists. In other words, the nonrecourse factor who assumes credit risk bears the credit loss and incurs bad debt if a purchased account does not collect due solely to financial inability of the account debtor to pay.

- ^ Four Centuries of Factoring; Hillyer, William Hurd; Quarterly Journal of Economics MIT Press 1939; D. Tatge, D. Flaxman & J. Tatge, American Factoring Law (BNA, 2009)

- ^ Bankers and Pashas: International Finance and Economic Imperialism in Egypt; Landes, David S.; Harper Torchbooks 1969

- ^ Factoring, Jones, Owen; Harvard Business Review February 1939 and Factoring as a Financing Device, Silverman, Herbert R.; Harvard Business Review, September 1949; D. Tatge, D. Flaxman & J. Tatge, American Factoring Law (BNA, 2009)

- ^ Silverman, Herbert R.; Harvard Business Review, September 1949

- ^ Hillyer

- ^ Silbert HBR Jan/Feb 1952

- ^ Good Capitalism Bad Capitalism and The Economics of Growth and Prosperity; Baumol, William J., Litan, Robert E., and Schramm, Carl J. Yale University Press 2007

- ^ EU Federation for Factoring and Commercial Finance

- ^ The return on its investment can be estimated by looking at its Net Income Relative to its Total Assets

- ^ William J. Baumol, The Quarterly Journal of Economics, (Nov, 1952), 545-556.

- ^ As a general rule, when cash flow tends to be positive on average. However, as mentioned, there are periods of time in which cash flow can be negative (more cash flows out than in).

External links

- About.com article on invoice factoring

- United Nations Convention on the Assignment of Receivables in International Trade 2004

- 'Role of "Reverse Factoring" in Supplier Financing of Small and Medium Sized Enterprises'

- 'International Factors Group - The International Association for Factoring '

- 'EU Federation for Factoring and Commercial Finance' - The representative Body for the Factoring and Commercial Finance Industry in the EU

- Credit Research Foundation - Understanding Commercial Factoring & Credit Insurance